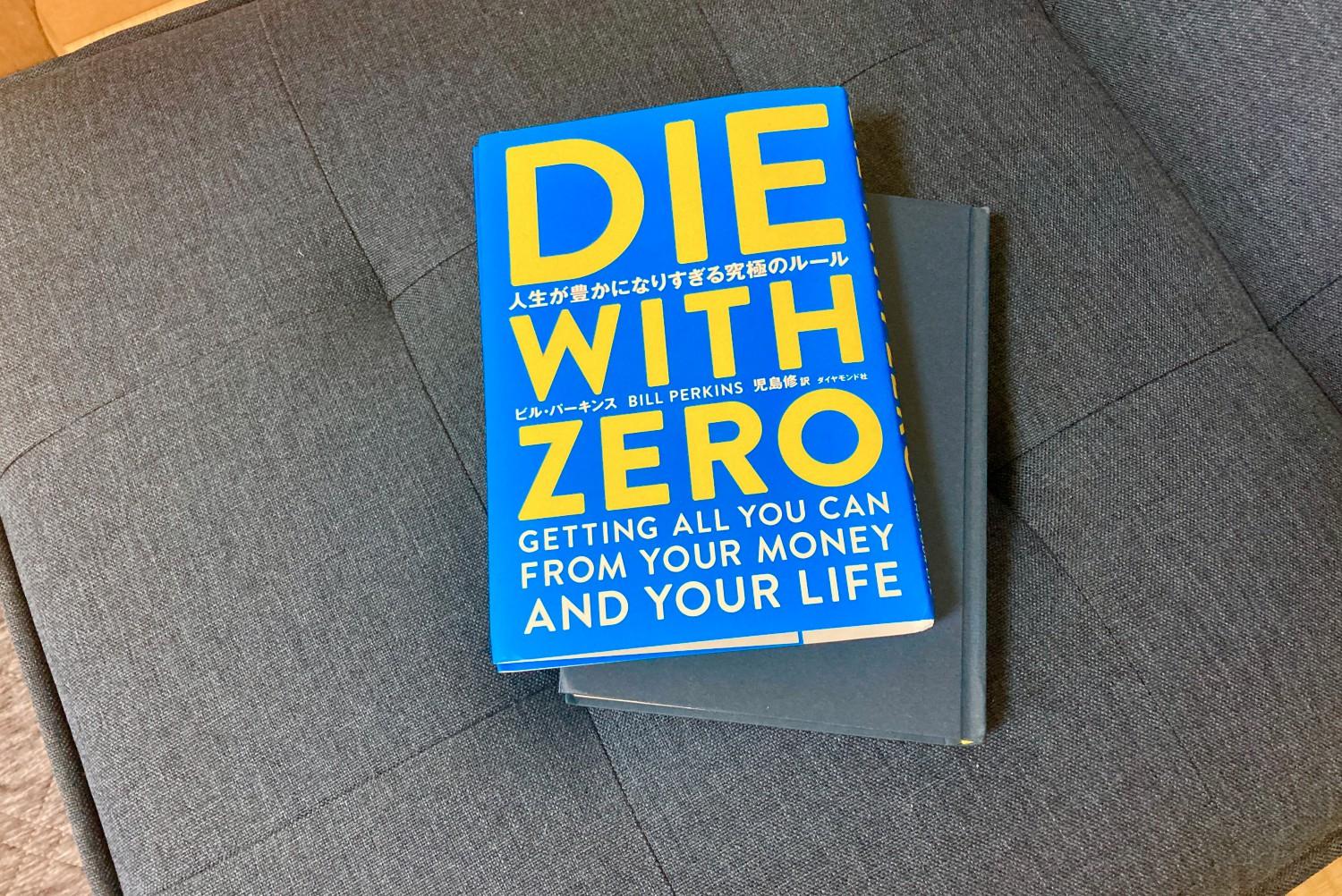

- Overview

- Summary

- No Wealth Without Health

- The Concept of Distributing Life Energy

- When Does the Ant Get to Play?

- Experiences as Investment

- Sacrificing Precious Years for the Final Months of Life?

- Planning to Leave an Inheritance? Then Give It Now!

- Donating After Death is Terribly Inefficient

- It’s Not About Retiring Early—It’s About Spending More Than You Earn at Some Point

- It’s Not About Wasting Money—It’s About Spending for Good Memories

- Impressions

Overview

I read this book after it was recommended by a friend.

- Midori-san: “I needed to hit that ‘Free shipping for Amazon orders over 3,500 yen’ thing, so I bought that Die with Zero book you mentioned the other day.”

- Friend: “What?! You should have told me, I would have lent it to you.”

- Midori-san: “Ah, I see. Thank you, I’ll take you up on that next time.”

- Friend: “Actually, you don’t even need to read it!! It just says ‘The best thing is to spend all your money before you die!’”

- Midori-san: “Wow, that’s quite the summary.”

Here’s my summary and thoughts.

Summary

The best thing is to spend all your money before you die!! The book pushes this idea from multiple angles. If any of them resonate with you, put them into practice—that’s the structure of this work.

No Wealth Without Health

- “Life is movement.” As you age and moving becomes painful, the range of experiences you can have decreases.

- This means that the less physical strength you have, the less value your money holds.

- In other words, as you age, your ability to extract value from your money decreases.

- You should spend money during your golden years—when you’re young—because that’s when your ability to extract value from it is at its peak.

The Concept of Distributing Life Energy

- Based on the book Your Money or Your Life, which introduced the concept of “life energy.”

- This is apparently the original inspiration for the well-known FIRE movement.

- We work for an hour, earn an hourly wage, and use that wage to buy things. In this view, you are converting that first hour of life energy into goods.

- If you die with unused money, it means you have thrown away life energy (time) that you worked for.

When Does the Ant Get to Play?

- The fable of the ant and the grasshopper is overvalued, and the mindset that saving is always good has spread too far.

Experiences as Investment

- Experiences aren’t a one-time profit; they become assets that enrich your life and generate ongoing returns through memory.

- The idea is: Experiences = Memories = Investments = Dividends = Enriched Life.

- Social media’s “3 years ago today you did this” feature leverages people’s ability to feel happiness from past memories.

Sacrificing Precious Years for the Final Months of Life?

- One common reason for hoarding wealth is “medical costs in old age.” The author rebuts this.

- “Would you sacrifice precious years now for end-of-life care when you can’t even move? Do you think that’s rational?” “In old age when you can’t move, what truly has value is not money for terminal care, but the memories of youthful experiences.”

Planning to Leave an Inheritance? Then Give It Now!

- Another common reason for hoarding is “leaving money for the children.” The author rebuts this.

- Giving to your children isn’t the problem. But by the time you die, the period when they can use the money most effectively will have already passed.

- The age when children can get the most value from an inheritance is between 26 and 35.

Donating After Death is Terribly Inefficient

- If you don’t donate while alive, “even though the money exists, people who need help now won’t benefit from it”—an incredibly inefficient outcome.

- Donating early outweighs the advantage of “investing the money first to grow it before donating.”

- Education donations are particularly effective now: The more people receive education, the lower the rates of poverty, crime, and violence in that region. Thus, donating to education is an effective social investment.

It’s Not About Retiring Early—It’s About Spending More Than You Earn at Some Point

- For those who say, “But I like working, I don’t want to quit”: Most people should aim for their peak net worth between ages 45 and 60.

It’s Not About Wasting Money—It’s About Spending for Good Memories

- The author is not recommending luxury restaurants or expensive cars.

- Spend money on things you believe “will be memories you can look back on and feel happy about in the future.”

Impressions

To sum it up:

- What makes life most wonderful is a wealth of good memories.

- The way to gain many of them is to extract value efficiently from your time and money.

- The concrete way to do that is to stop hoarding money when young and instead accumulate experiences.

- Then, as you get older, stop hoarding money you don’t even plan to use, and move toward Die with Zero.

The original subtitle is Getting All You Can from Your Money and Your Life, which fits perfectly. Throughout the book, I kept picturing the idea of squeezing every drop of energy out of “time” and “money” and converting it into “experiences” to store in the brain—like extracting energy from fossil fuels. I suspect that’s not far from the image the author had in mind.

Some scattered thoughts:

-

The idea that experiences provide ongoing returns in later life (making them comparable to investments and dividends) was easy to understand. My own wild camping trips and experiences in Romania tend to get a good reaction from people.

- (2024-01-19) Wild Camping in Winter – On Temperature

- I’ve recorded a huge number of my experiences on my blog, which means I’m extracting dividends from those experiences quite efficiently.

- It’s easy to understand that those who invested in their health when young reap greater rewards later. Anyone who’s been running regularly for years—not just me—would get this.

- This book was not typed out personally by Bill Perkins, but written by writer Marina Krakovsky.

- The friend from the opening worked during the week in her youth, but spent every weekend traveling domestically or abroad, going to music festivals, and using up all the money she earned. …Well, no wonder she said “You don’t even need to read it!!” She had already been living the book’s philosophy for years before it was published.

- The awe I feel when hearing her stories is probably similar to the respect one feels toward an investor who built a fortune at a young age.